Even if the US is headed for greater things, it doesn’t preclude the possibility of a major market correction in housing. But for housing to crash, a series of factors would have to align.

12 Housing Crash Factors

- excessively high home prices via a price bubble

- increasing underwater mortgages

- fast rising interest mortgage rates

- slowing economy and sudden rises in unemployment

- wage growth not keeping up with home prices

- tax changes and geo-political shifts

- trade deal disturbance

- a stock market bubble and volatility

- high level of consumer debt affecting debt servicing

- cost of living rises

- risky low rate mortgages for new home buyers

- high oil and energy prices

Even though the housing markets have substantial strength, the world is a very connected place. If China and other economies were to collapse, it might be enough to send the stock markets and real estate markets plummeting. Dent says New York, Los Angeles, San Francisco, Chicago and Boston are the riskiest markets.

Top 10 Cities Most Likely to Experience a Housing Crash

From a report in AOL.com here are the top ten US Cities most likely to experience a crash:

- Portland, Oregon

- Charleston, SC

- Buffalo, NY

- Fresno, CA

- Los Angeles, CA

- Dallas, TX

- Salt Lake City, UT

- Austin, TX

- San Jose, CA

- San Francisco, CA

Interesting list, dominated by California and Texas, which have been doing well economically. With oil prices rising, I wonder if that will calm the situation in Dallas and Houston?

Tyler Durden of zerohedge.com discusses in a post how homeowners are burdened in debt and unable to refinance their mortgages. He points to his key statistic that mortgage owners will not be refinancing their mortgages in 2017 which points in the direction of bubble bursts and crashes.

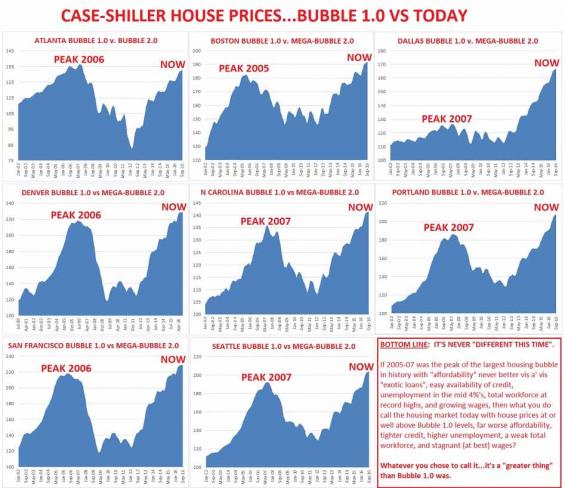

This chart below paints a very scary picture, that it’s worse than 2006. Not only does it correlate 2017 with 2006, it shows that we’re up high on a dangerous cliff in some cities. However, most cities aren’t in this situation, so if a collapse in California, New York and Texas were to occur, other cities might survive okay.

There are other mitigating factors too such as the strengths in the economy, foreign investors buying property, and rising optimism and confidence since Trump won the election. At this point, we’re wondering if Obama and Clinton are relieved not to have to face the mess they created? Trump seems to be up to the task and yet, he has purportedly said he would enjoy watching the crash, even if it takes down some of his real estate empire. Is this just a comment on high home prices?

The cost and availability of credit provide fuel for a bubble to inflate, inviting even less experienced, or less credit-worthy players into the game, all of whom believe they will sell their recently purchased assets at ever-increasing prices — from a CNBC post.

That credit is being freed up in 2018/2019, but will it fast enough to create huge instability if mortgage rates don’t rise precipitously? Here’s Seattlebubble’s reasoning on why we may not be in a housing bubble/crash situation:

- still lots of all-cash buyers, with few zero-down buyers

- no crazy neg-am, fog-a-mirror, interest-only home loans like last time

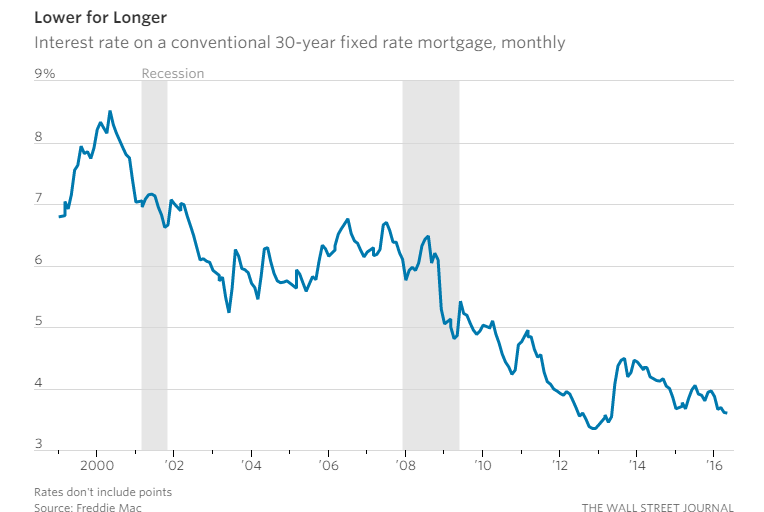

- interest rates remaining low

- affordability index not as bad

- buyers and lenders more cautious

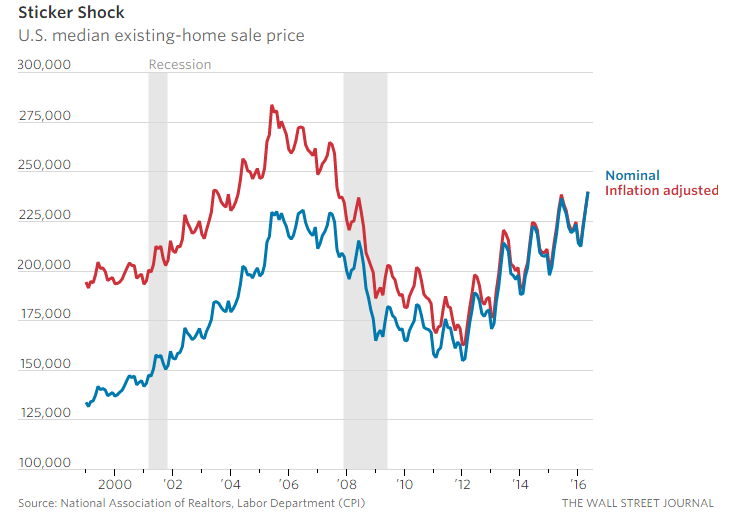

Home prices aren’t as high as they were in 2006/2007 and mortgage rates are much lower:

We are pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the Nation. See Equal Housing Opportunity Statement for more information.